USDJPY Price Analysis: Bulls tread with caution as bearish coil dominates

- USDJPY is coiled and could be about to continue to the downside.

- US Dollar bulls eye a correction into the 108.00s, DXY.

USDJPY is relatively flat in the session after falling from a high of 140.29 to a low of 138.72, now trading back at 139.30. The greenback has been under pressure, sliding from currently elevated levels on the sentiment that the Federal Reserve will be forced to pause its rate hikes. As interest rate differentials with other countries narrow, the greenback would be expected to continue to slide. The sentiment is fueling a bid in the Yen as the following technical analysis will illustrate:

USDJPY daily chart

The price has broken prior supporting trendlines and is now meeting fresh dynamic support and is coiling into a bearish continuation triangle.

USDJPY H4 charts

On the 4-hour chart we can see the important levels and price imbalances should there be a break to the upside.

Zoomed in, we can see this more clearly.

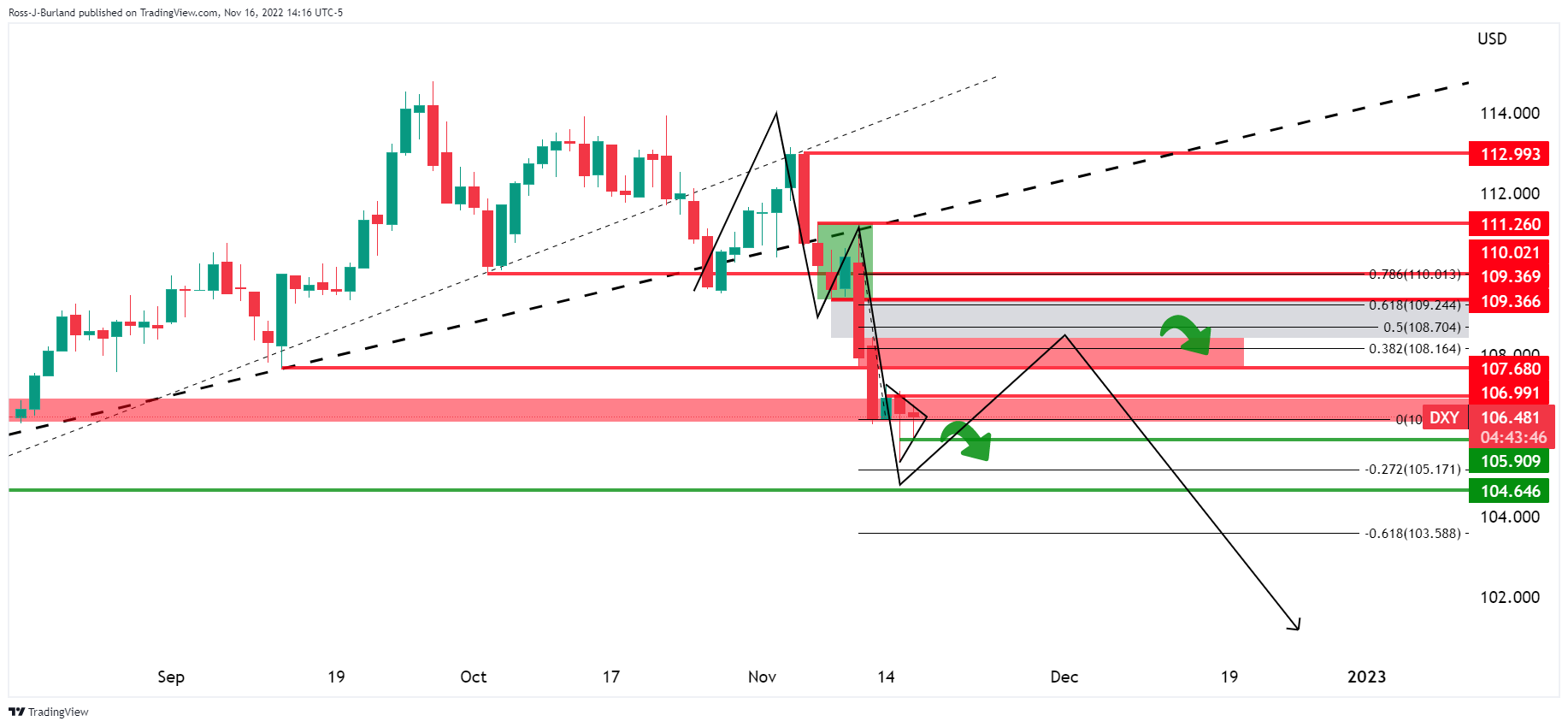

DXY daily charts

The US Dollar is also coiled and bearish while below the resistance. The M-formation, on the other hand, is a bullish feature whereby the price would be expected to revert towards the neckline, at least to test the 38.2% Fibonacci.