Gold price falls on strong US Nonfarm Payrolls yet is poised for weekly advance

- XAU/USD falls after strong NFP data cuts rate cut hopes, but holds weekly gain above 1.30%.

- US adds 139K jobs in May; Unemployment Rate steady at 4.2%, boosting US Dollar and Treasury yields.

- Fed cut expectations fade as traders reassess outlook ahead of June 17–18 FOMC meeting.

Gold price extended its losses for the second consecutive day on Friday but is poised to finish the week with gains of over 1.30% after the latest Nonfarm Payrolls report in the United States (US) was solid, pressuring traders to trim their bets that the Federal Reserve (Fed) will ease monetary policy. At the time of writing, the XAU/USD trades at $3,316, down 0.84%.

The US Bureau of Labor Statistics (BLS) revealed that the labor market remains resilient as the Unemployment Rate figures remained unchanged compared to April. In the meantime, Wall Street recovers some of its Thursday losses amid the ongoing feud between US President Donald Trump and Tesla CEO Elon Musk, spurred by the House of Representatives' approval of the US debt ceiling increase.

Bullion prices took a hit as the buck showed signs of life, climbing 0.49% as depicted by the US Dollar Index (DXY). The move was sponsored by investors adjusting their estimates of the Fed rate cut and higher US Treasury bond yields.

Although Gold is taking a hit, heightened tensions between Russia and Ukraine and the prolonged conflict between Israel and Hamas could still drive prices higher.

Next week, the US economic docket will be absent of Fed speakers as they enter the blackout period ahead of the June 17-18 meeting. Traders would be eyeing Consumer Price Index (CPI) figures, followed by the Producer Price Index (PPI) and the University of Michigan Consumer Sentiment.

Daily digest market movers: Gold drops as soaring US yields underpin the US Dollar

- The US 10-year Treasury yield surges over nine-and-a-half basis points to 4.484%. US real yields have followed suit and are also up for the same amount at 2.196%, a headwind for Bullion prices.

- May US Nonfarm Payrolls print surpassed forecasts of 130K, rose by 139K but missed April’s downwardly revised 147K. Although the labor market is cooling, it remains in great condition as the US economy decelerates.

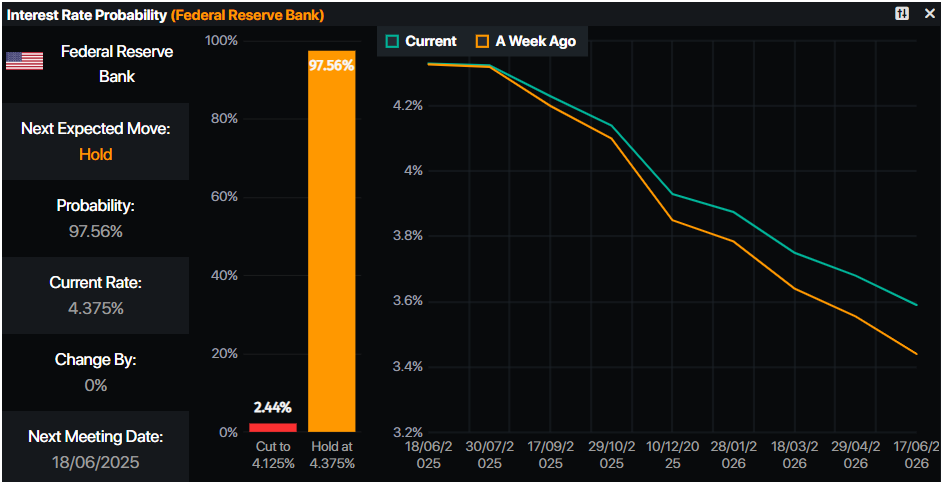

- The Unemployment Rate stood at 4.2%, and along with the jobs report, sparked a repricing of interest rates, with less than two expected cuts by the Fed toward the end of 2025.

- Metals Focus said, “Central banks worldwide are set to buy 1,000 metric [tonnes] of Gold in 2025, marking a fourth straight year of massive purchases as they shift reserves away from [US D]ollar assets.”

- The de-escalation of US-Sino trade war tensions could exert downward pressure on Gold, which so far has gained over 26% in the year.

- Money markets suggest that traders are pricing in 44.5 basis points of easing toward the end of the year, according to Prime Market Terminal data.

Source: Prime Market Terminal

XAU/USD technical outlook: Gold remains bullish despite losing some ground below $3,360

Gold price consolidates after the XAU/USD has fallen to a four-day low of $3,316 but holds above $3,300, which is seen as a crucial floor that, if cleared, could open the path to test $3,250.

The Relative Strength Index (RSI) shifted bearish, indicating that XAU/USD could extend its losses; however, the overall trend favors the bulls.

If Gold stays above $3,300, this could pave the way to test the current week’s peak of $3,403 hit on June 5, followed by the $3,450 mark. If surpassed, up next lies the all-time high at $3,500.

On the other hand, if Gold falls below $3,300, sellers could send XAU/USD on a tailspin, testing the 50-day Simple Moving Average (SMA) at $3,235, followed by the April 3 high, which has since turned into support at $3,167.

Gold FAQs

Gold has played a key role in human’s history as it has been widely used as a store of value and medium of exchange. Currently, apart from its shine and usage for jewelry, the precious metal is widely seen as a safe-haven asset, meaning that it is considered a good investment during turbulent times. Gold is also widely seen as a hedge against inflation and against depreciating currencies as it doesn’t rely on any specific issuer or government.

Central banks are the biggest Gold holders. In their aim to support their currencies in turbulent times, central banks tend to diversify their reserves and buy Gold to improve the perceived strength of the economy and the currency. High Gold reserves can be a source of trust for a country’s solvency. Central banks added 1,136 tonnes of Gold worth around $70 billion to their reserves in 2022, according to data from the World Gold Council. This is the highest yearly purchase since records began. Central banks from emerging economies such as China, India and Turkey are quickly increasing their Gold reserves.

Gold has an inverse correlation with the US Dollar and US Treasuries, which are both major reserve and safe-haven assets. When the Dollar depreciates, Gold tends to rise, enabling investors and central banks to diversify their assets in turbulent times. Gold is also inversely correlated with risk assets. A rally in the stock market tends to weaken Gold price, while sell-offs in riskier markets tend to favor the precious metal.

The price can move due to a wide range of factors. Geopolitical instability or fears of a deep recession can quickly make Gold price escalate due to its safe-haven status. As a yield-less asset, Gold tends to rise with lower interest rates, while higher cost of money usually weighs down on the yellow metal. Still, most moves depend on how the US Dollar (USD) behaves as the asset is priced in dollars (XAU/USD). A strong Dollar tends to keep the price of Gold controlled, whereas a weaker Dollar is likely to push Gold prices up.