DXY inter-markets: extra gains need a stronger catalyst

The US Dollar Index (DXY) – which measures the buck vs. its main rivals – is prolonging its upbeat momentum on Wednesday, although the upside seems to have struggled once again ahead of last week’s tops in the 101.70/75 band.

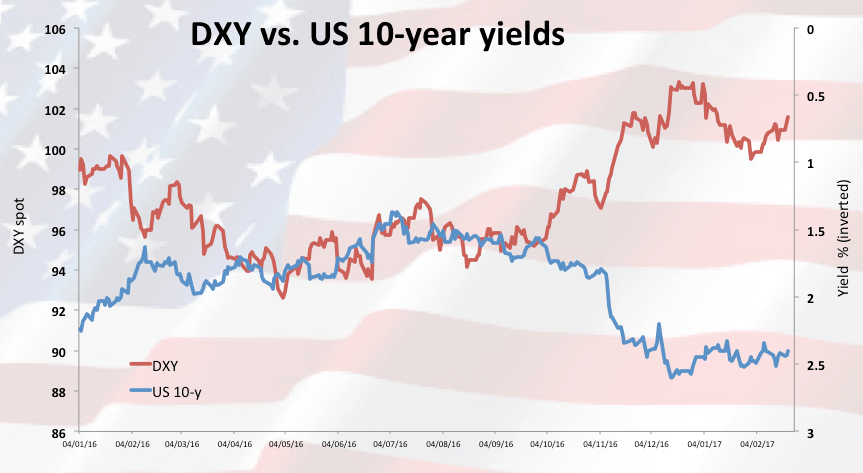

Yields in the US money markets are not accompanying the up move in the greenback, today retreating to the area of daily lows at the time of writing. The 10-year reference has so far receded to the 2.40% region, significantly lower than recent peaks above 2.52% in the wake of the first testimony by Chair Yellen last week.

Expectations of a rate hike by the Federal Reserve at the March meeting keep sustaining the rally in USD, with the probability of higher rates next month is at just below 18% according to CME Group’s FedWatch tool and based on Fed Funds futures prices.

The FOMC minutes due later today should shed some extra light on the governors’ recent views, while the prospects of potential fiscal policies and their impact on the economy under Trump’s administration emerge as the next ‘big issue’ for the buck.

In the meantime, DXY should find interim resistance around last week’s tops in the 101.70 region ahead of the 23.6% Fibo retracement of the November-January up move and previous to 102.96 (spike January 11). In a case of a resumption of the bearish sentiment, the recent gap higher in the 101.00 area emerges as the initial test, ahead of the 100.50/40 band, where sit the 20-day sma and recent lows.