Gold continues to hover above $1270

The precious metal leaped to $1275 for the first time since Trump's election victory on Tuesday as a wave of risk aversion swept through global markets. Although the metal seems to have lost some bullish momentum, it remains above $1270. At the moment, the XAU/USD pair is up 1.5% at $1273.

The yellow metal's safe haven appeal seems to be the primary driver of the price action. "Heightening geopolitical fears are likely to constrain investors from a mood change...(and) are likely to keep the safety trade, gold, and U.S. Treasuries, in play," Peter Cardillo, chief market economist at First Standard Financial told Reuters.

In fact, the yield on the 10-year U.S. Treasury bond yield is losing 2.5% on the day. As the investors desire the safer Treasury bond, the high demand drags the yields lower. On the other hand, the equity indices, which rises when the investors are willing to become risk takers, reflect the weak sentiment as they remain in the red despite the rising crude oil prices.

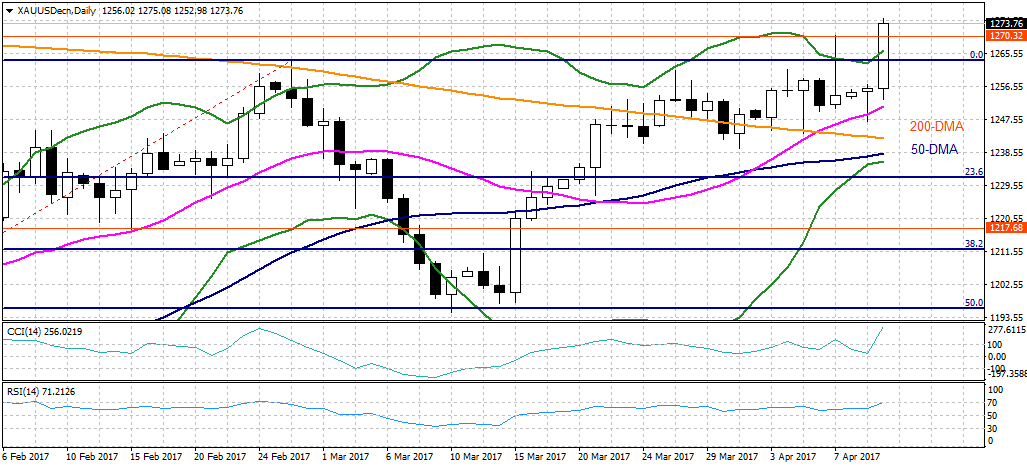

Technical outlook

The precious metal faces the first hurdle at $1280 (Oct. 31 high) followed by $1291 (Nov. 11 high) and $1300 (psychological level). On the flip side, supports could be found at $1270 (horizontal level/former resistance), $1261 (Apr. 4 high) and $1242 (200-DMA).

- Gold: Short term outlook have improved – Natixis