When are the German IFO surveys and how they could affect EUR/USD?

The German IFO Business Climate Overview

The German Ifo surveys for February are lined up for release later today at 0900 GMT. The headline Ifo Business Climate Index is expected to tick lower to 117.0 in Feb. The Current Assessment sub-index is also seen lower at 127.0 this month, while the Ifo Expectations Index – indicating firms’ projections for the next six months – is likely to ease to 107.9 in the reported month.

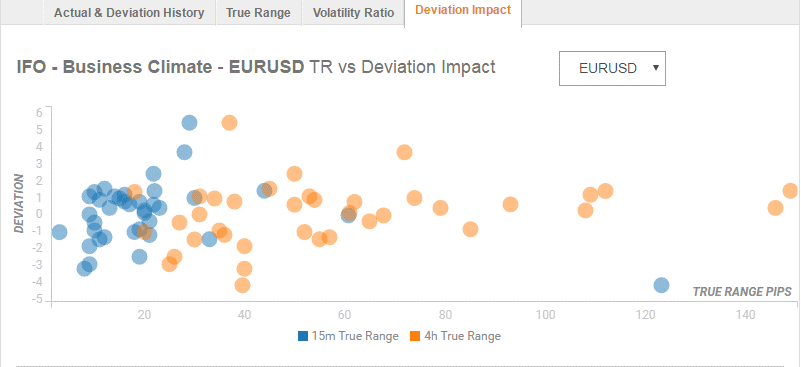

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 3 and 40 pips in deviations up to 2.4 to -3.2, although in some cases, if notable enough, a deviation can fuel movements of up to 60 pips.

How could affect EUR/USD?

The spot could find support and head back towards the 1.23 handle on a positive surprise, while a test of 1.2200 levels cannot be ruled out on a disappointing headline figure.

According to Karen Jones, Analyst at Commerzbank, Technically, “EUR/USD continues to weigh on the downside following its failure move to a new high. The new high has been accompanied by a divergence of the daily and weekly RSI and Friday’s price action represented a key day reversal which suggests that the market is likely to remain under pressure. Intraday rallies are indicated to fail circa 1.2340, and while capped by this and the 20-day ma at 1.2371, the market will remain directly offered.”

However, the reaction to the data is likely to be short-lived, as all eyes remain on the ECB January meeting minutes due later today for fresh trading impetus.

Key Notes

Eurozone: Focus on German IFO and ECB Minutes – TDS

EUR/USD Forecast: approaching double-top neckline support ahead of ECB minutes

About the German IFO Business Climate

This German business sentiment index released by the CESifo Group is closely watched as an early indicator of current conditions and business expectations in Germany. The Institute surveys more than 7,000 enterprises on their assessment of the business situation and their short-term planning. The positive economic growth anticipates bullish movements for the EUR, while a low reading is seen as negative (or bearish).