EUR/NZD: The calm before the ECB storm

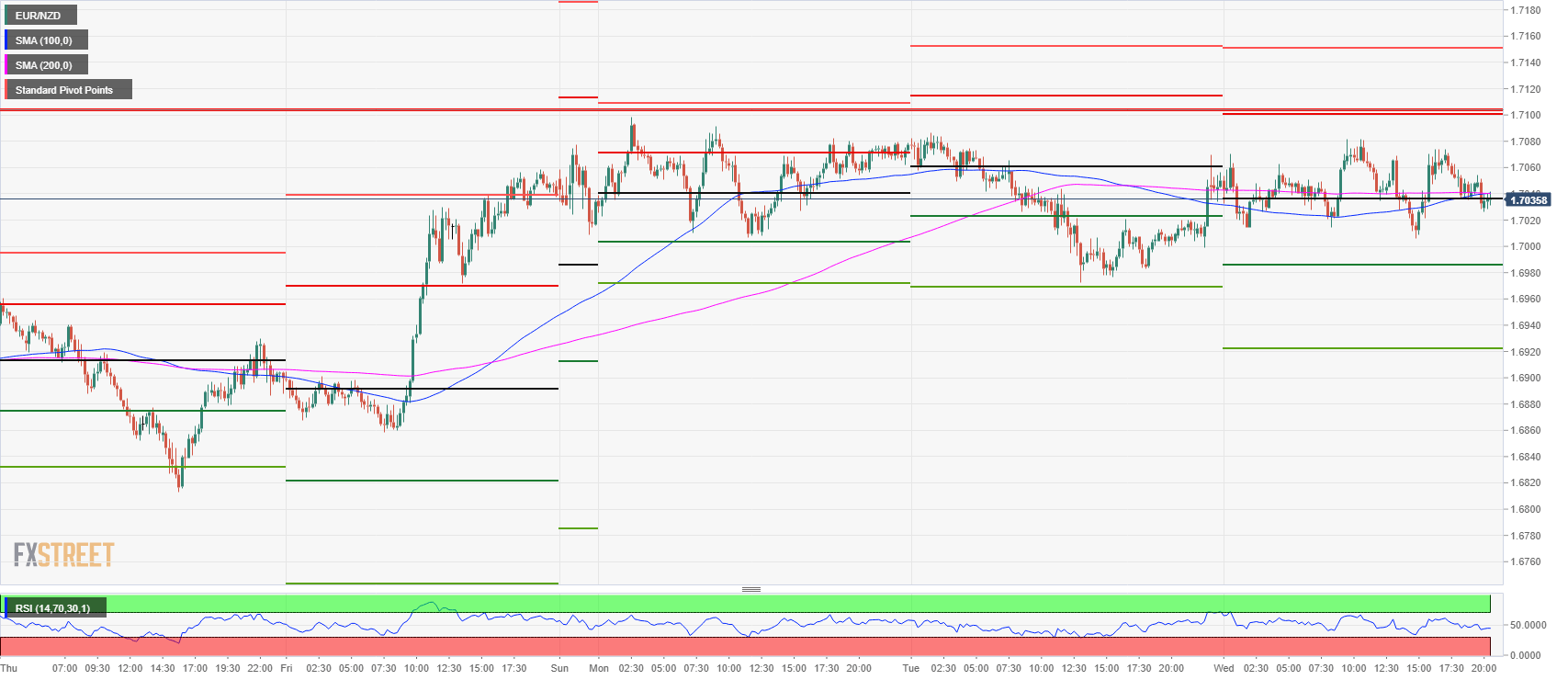

- EUR/NZD is trading in the 1.7010-1.7080 range.

- ECB meeting should offer some directionality to the pair.

The EUR/NZD is trading at around 1.7047 up 0.21% on the day exhibiting the same theme of most pairs on Wednesday characterized by tiny ranges around the 100 and 200-period simple moving average (15-minute chart) and the daily pivot point as investors are eagerly waiting for Thursday’s ECB meeting.

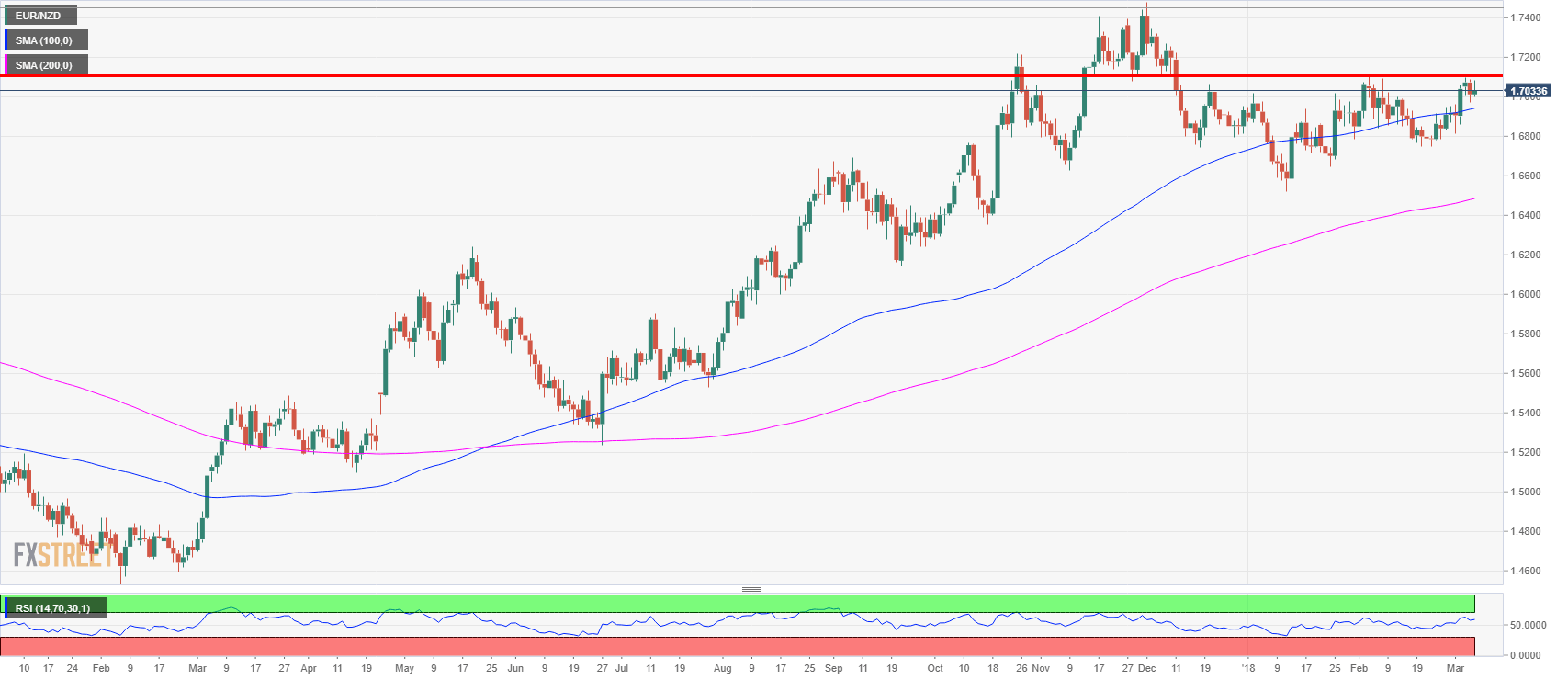

EUR/NZD daily chart

The ECB policy meeting is taking center stage on Europe’s calendar. Market participants are expecting a relatively hawkish tone on key interest rates and no changes on the asset purchases ($30bn per month until September). The market will focus on President Draghi’s press conference.

New-Zealand Manufacturing sales on Wednesday at 21.45 GMT is unlikely to offer any direction to the EUR/NZD pair. Same applies for Electronic card retail sales on Thursday as it will likely be overshadowed by Draghi’s comments.

EUR/NZD 15-minutes chart

The EUR/NZD failed to break above the 1.7100 this week on Monday and since then it has been rotating slightly lower. On Wednesday the price was trapped between the 1.7010 and the 1.7080 range. The resistance that bulls will need to overcome if they want to create a rally is the 1.7100 level. Further up, the next scaling point is likely going to be the 1.7200 psychological level. To the downside, sellers will need a clear break below 1.6970. Further down 1.6920, at the S2 pivot, is also likely to provide some support if reached. However, traders need to be aware that the ECB meeting might stir the Euro in either direction with a larger than usual pip-range.