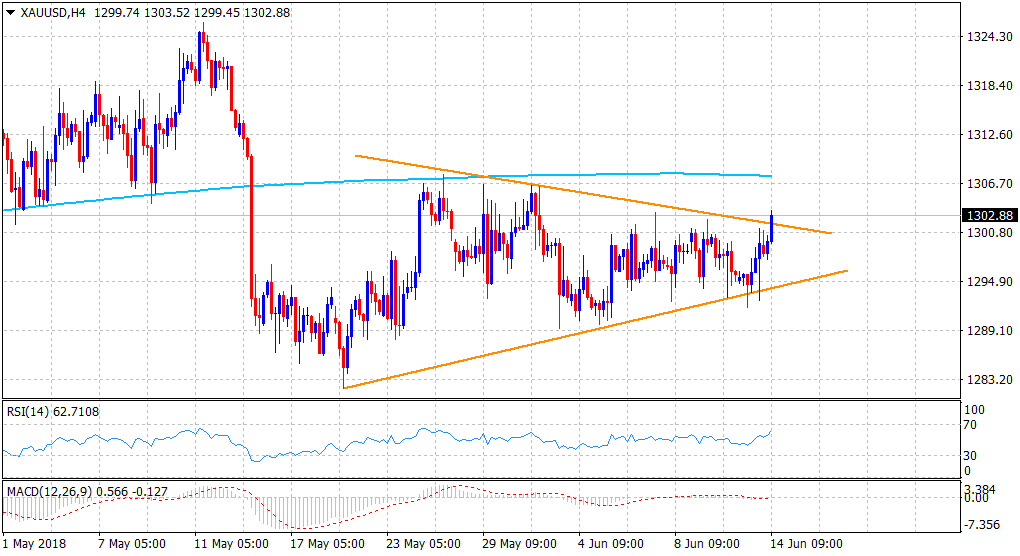

Gold Technical Analysis: bullish breakout sets the stage for a retest of 200-DMA barrier

• Extends the post-FOMC up-move and finally broke through a key descending trend-line resistance, part of a symmetrical triangular formation on short-term charts.

• A follow-through technical buying should support an extension of the ongoing momentum further towards challenging the very important 200-day SMA.

• The $1300 round figure mark now seems to protect the immediate downside amid reviving safe-haven demand and weaker tone surrounding the US Dollar.

Gold 4-hourly chart

Spot Rate: $1302.88

Daily Low: $1297.56

Trend: Bullish

Resistance

R1: $1307.57 (200-day SMA)

R2: $1314.91 (May 15 swing high)

R3: $1321.30 (May month daily closing high)

Support

S1: $1301.96 (symmetrical triangle break-point)

S2: $1297.75 (100-period SMA H4)

S3: $1294.18 (ascending trend-line)