EUR/GBP Technical Analysis: Awaits UK jobs data/Carney to breakthrough a 1-week old trading range

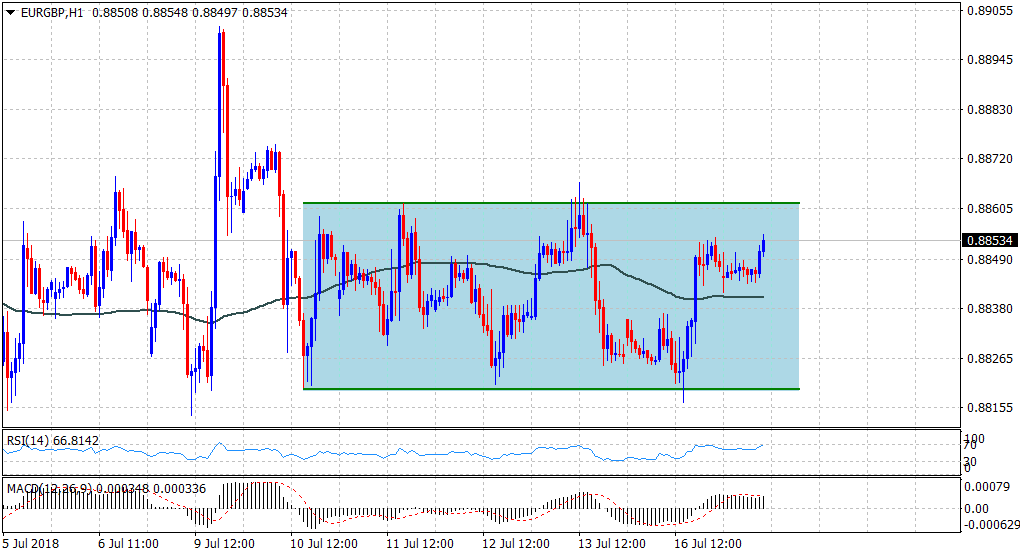

• The cross has been oscillating within a broader trading range over the past one-week or so, forming a rectangular chart pattern on the 1-hourly chart.

• With bulls managing to keep the cross above 100-hour SMA, positive short-term technical indicators support prospects for a bullish breakout.

• The BoE Governor Mark Carney and Deputy Governor Jon Cunliffe's testimony followed by the key US jobs data might provide the required momentum to finally break through the trading range.

EUR/GBP 1-hourly chat

Spot rate: 0.8853

Daily Low: 0.8842

Trend: Sideways

Resistance levels

R1: 0.8865 (R1 daily pivot-point)

R2: 0.8902 (over 4-month tops set last Monday)

R3: 0.8935 (horizontal zone)

Support levels

S1: 0.8823 (200-day SMA)

S2: 0.8801 (S2 daily pivot-point)

S3: 0.8787 (100-day SMA)