Back

3 Apr 2020

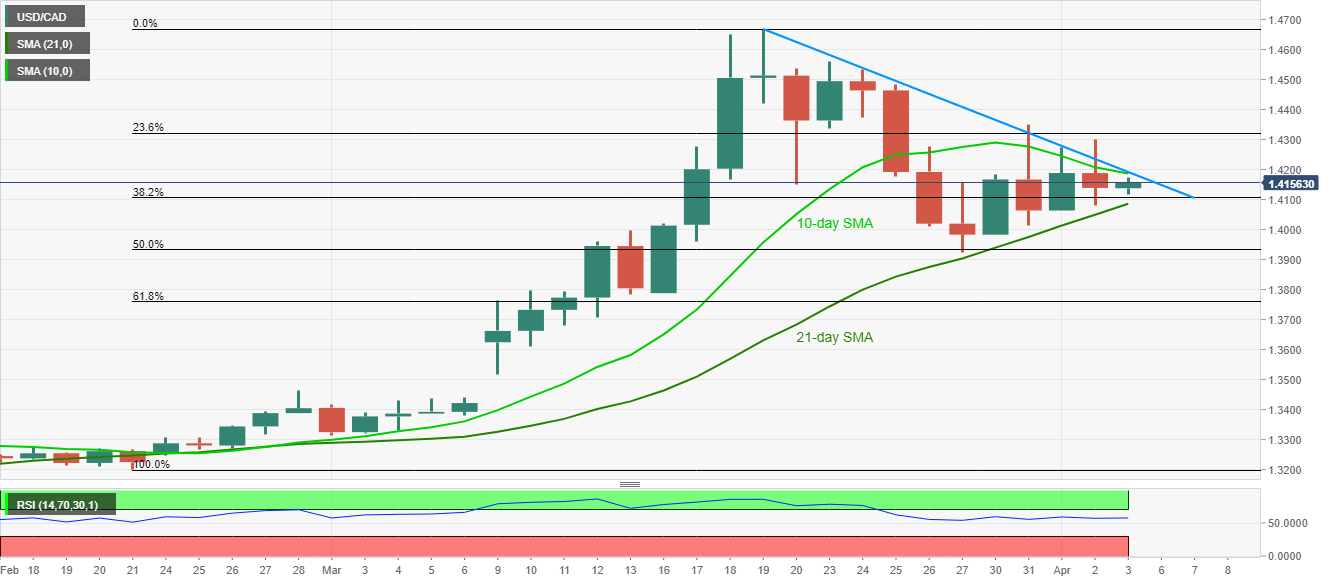

USD/CAD Price Analysis: Buyers look for entry beyond 1.4185/90

- USD/CAD funnels down to the exit between 21-day and 10-day SMAs.

- A two-week-old falling trend line adds strength to the resistance.

- The late-March low will be on the bears’ radars on the downside break.

While funneling down the weekly trading range between 21/10-day SMAs, USD/CAD prints mild gains while taking the bids to 1.4155 during early Friday.

In addition to 10-day SMA, a downward sloping trend line from March 19, also guard the pair’s immediate upside around 1.4185/90.

On the downside, 1.4085 comprising 21-day SMA seems to restrict the pair’s near-term declines.

While 1.4350 is likely on the bulls’ radars on the break above 1.4190, 1.4000 can offer an intermediate halt, below 1.4085, before dragging the quote to March 27 low surrounding 1.3920.

USD/CAD daily chart

Trend: Sideways