WTI climbs to 3-week highs near $23.00/bbl

- Prices of the barrel of WTI extends the rally above $22.00.

- Crude oil ignores the renewed US-China trade tensions.

- Baker Hughes reported another drop in US oil rig count.

Prices of the barrel of the West Texas Intermediate are prolonging the upbeat momentum at the beginning of the week beyond the $22.00 mark, advancing more than 12% at the time of writing.

WTI looks to COVID-19, trade

Prices of the WTI are navigating the area of 3-week highs above the $22.00 mark per barrel on Monday, ignoring the renewed effervescence on the US-China trade front and the prevailing risk-off sentiment.

WTI has quickly regained composure following the meltdown in prices of the May contract to the vicinity of -$40.00 per barrel earlier in April, bouncing off sharply from the oversold territory and now posting gains for the fifth consecutive session well above the key $20.00 mark per barrel.

Extra support for crude prices came after the speculative community pushed net longs to the highest level since early August 2018 during the week ended on April 28th, as per the latest CFTC report.

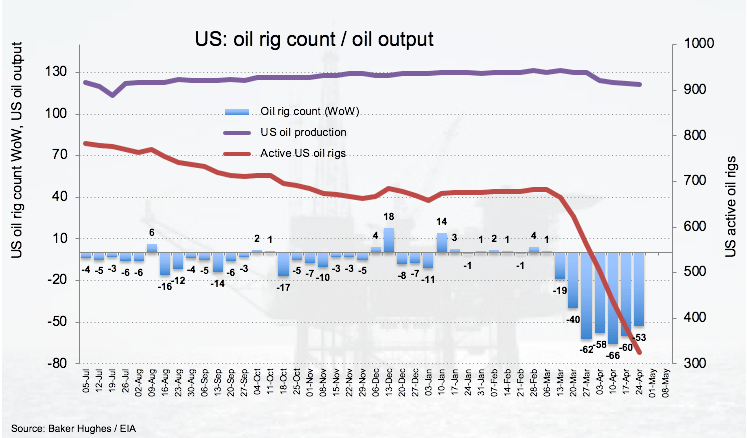

On another front, driller Baker Hughes reported on Friday the seventh consecutive drop in US oil rig count, this time by 53 to 325 active oil rigs. Later in the week, the API and the EIA will publish their reports on crude oil inventories on Tuesday and Wednesday, respectively.

WTI significant levels

WTI significant levels

At the moment the barrel of WTI is gaining 14.58% at $22.60 facing the next resistance at $22.82 (high May 4) seconded by $29.11 (weekly/monthly high Apr.3) and then $29.55 (55-day SMA). On the downside, a breach of $10.27 (low Apr.28) would expose $6.60 (low Apr.21) and finally -$37.63 (all-time low Apr.20).