Back

11 May 2020

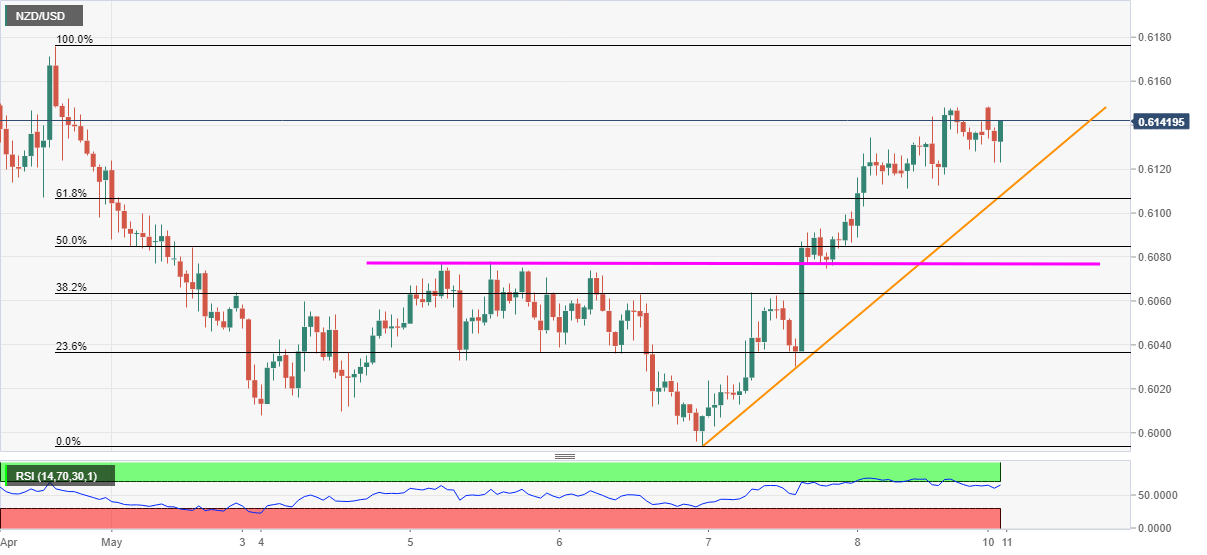

NZD/USD Price Analysis: Sellers look for entries below 0.6100

- NZD/USD drops recently, snaps two-day winning streak.

- Downbeat prints of New Zealand Electronic Card Retail Sales, increasing odds of RBNZ’s further QE weigh off-late.

- A confluence of the three-day-old rising trend line, 61.8% Fibonacci retracement limit immediate downside.

NZD/USD trades near 0.6140 during Monday’s Asian session. The pair dropped recently after New Zealand’s Electronic Card Retail Sales slumped 47.5% YoY in April from -1.8% prior. Also exerting downside pressure on the pair is the statement from NZIER (New Zealand Institute of Economic Research).

Even so, a confluence of a three-day-old ascending trend line and 61.8% Fibonacci retracement of April 30 to May 06 fall, around 0.6100, restricts the pair’s immediate downside.

Should the NZD/USD prices dip below 0.6100, Tuesday’s top near 0.6080 holds the key to the monthly low surrounding 0.5995.

Meanwhile, an upside clearance of 0.6150 can renew the buying pressure towards April month high close to 0.6175.

NZD/USD hourly chart

Trend: Further recovery expected