Back

18 Aug 2020

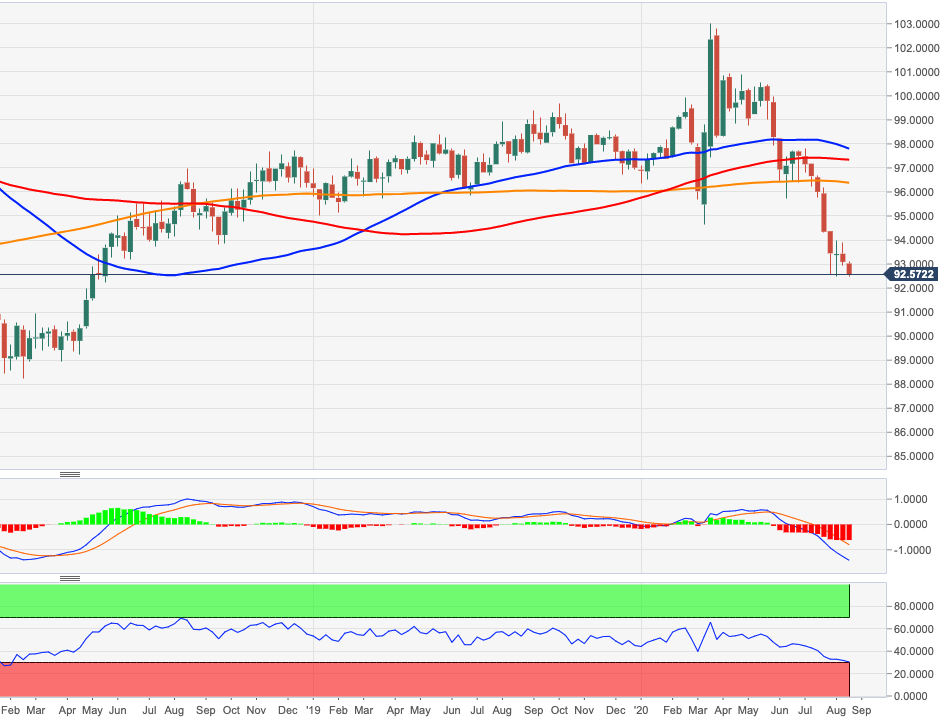

US Dollar Index Price Analysis: Extra losses now target 91.80

- DXY recorded new YTD lows in the 92.50/45 band on Tuesday.

- A deeper pullback should see the May 2018 low at 91.80 re-tested.

DXY remains under heavy downside pressure and recorded fresh 2020 lows in the 92.50/45 band earlier in the session.

The inability of the index to surpass recent tops in the 94.00 neighbourhood encouraged sellers to return to the markets and drag the dollar lower. That said, the next support of significance emerges at the May 2019 low at 91.80.

The offered stance in the dollar is expected to remain unchanged while below the 200-day SMA, today at 97.75.

DXY weekly chart