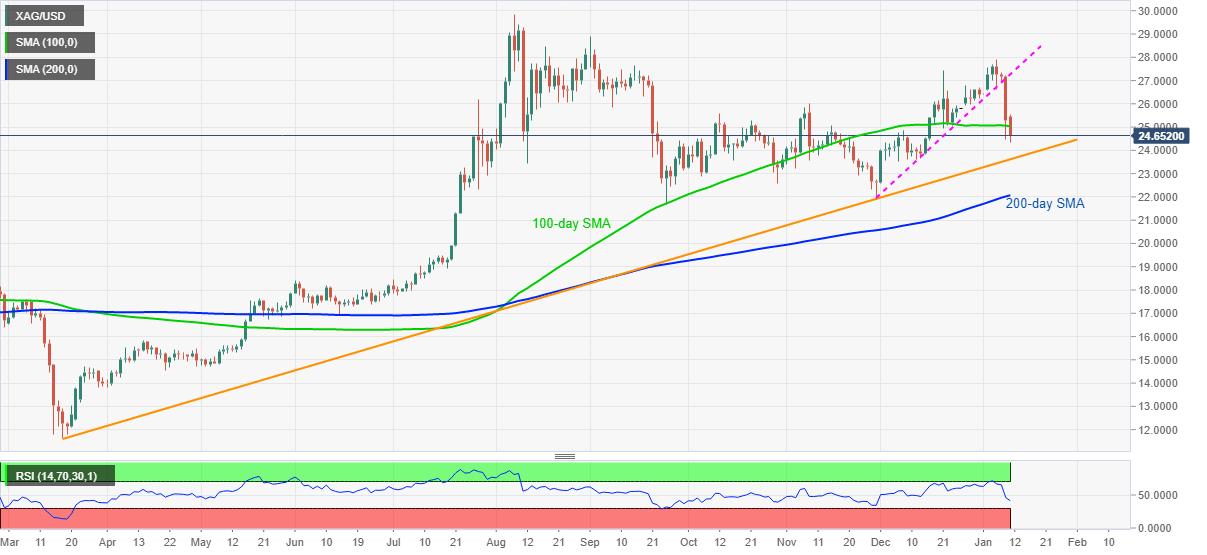

Silver Price Analysis: XAG/USD sellers cheer 100-day SMA break near one-month low

- Silver bears catch a breather after refreshing multi-day low.

- Downside break of 100-day SMA directs sellers toward an ascending trend line from March 18.

- Bulls look for entries beyond previous support line.

Having dropped to a fresh low since the mid-December, silver takes rounds to $24.60, down 2.70%, during early Monday. While a downside break of an ascending trend line from November 30 pleased the commodity sellers during last week, the latest south-run below 100-day SMA highlights a multi-month-old support line for sellers.

It should be noted that an absence of oversold RSI adds strength to the downside momentum.

That said, the $24.00 round-figure can offer an intermediate halt during the fall targeting an aforementioned support line, currently near $23.60.

Also acting as the key support is 200-day SMA, at $22.07 now, followed by November’s low of $21.89.

On the contrary, an upside break of 100-day SMA, currently around $25.03 can aim for November’s top near $26.00. However, any further rise needs to regain above the previous support line, at $27.25, to convince buyers. Additionally, the monthly high of $27.92 acts as an extra filter to the north.

Overall, silver prices have some more room to the downside before confronting the key technical supports.

Silver daily chart

Trend: Further weakness expected