AUD/JPY Price Analysis: Bulls catch a breather above 84.00 but not out of the woods

- AUD/JPY stays pressured inside a choppy range above 84.00.

- Bearish MACD favors sellers but 50-SMA, three-week-old support line challenge further weakness.

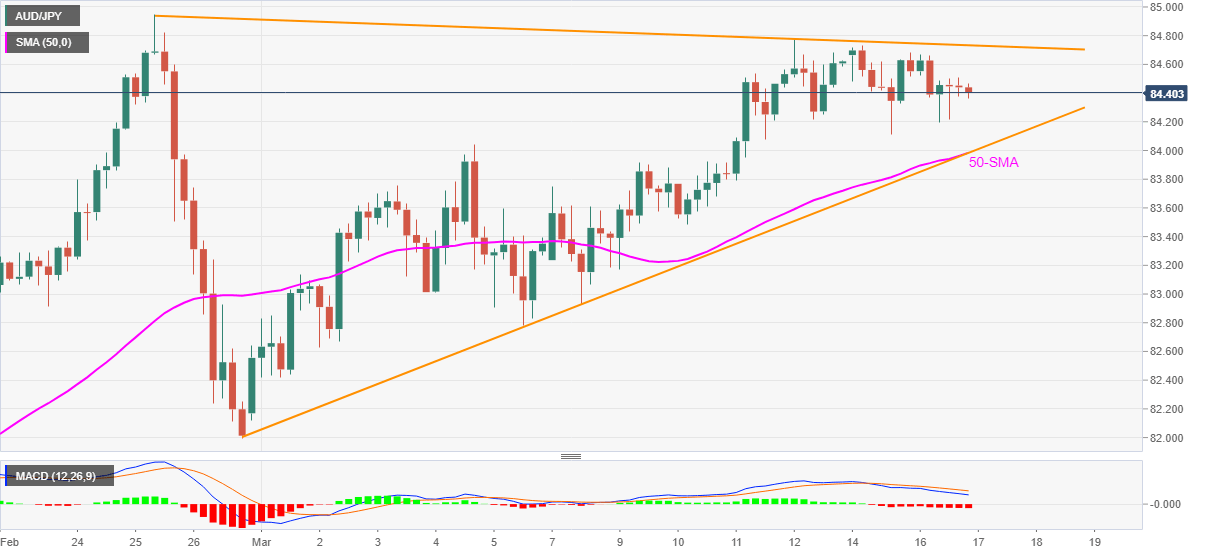

AUD/JPY wavers around 84.40 while keeping its four-day-long 60-pip range during the initial Asian session on Wednesday. In doing so, the pair funnels down the breakout of a short-term ascending triangle formation amid bearish MACD.

Although bearish signals from MACD and a gradual softening in the AUD/JPY prices keep sellers hopeful, a confluence of 50-SMA and an ascending support line from February 26, forming part of the stated triangle becomes the key hurdle for the bears’ entry.

It should, however, be noted that the current weakness of the quote seems to highlight the return of the 84.00 threshold on the chart. However, any further downside could validate a south-run towards refreshing the monthly low near 82.40.

Meanwhile, a decisive upside beyond 84.75 defies the bearish chart pattern, which in turn should propel the bulls towards crossing February’s multi-month top of 84.95 and aim the mid-February 2018 peak surrounding 85.60.

During the rise, the 85.00 round-figure should give breathing space to the AUD/JPY buyers.

AUD/JPY four-hour chart

Trend: Sideways