AUD/USD Price Analysis: Refreshes session tops, around 0.7630-35 region

- AUD/USD attracted some dip-buying and recovered around 40 pips from sub-0.7600 levels.

- Sliding US bond yields undermined the USD and helped the pair to regain positive traction.

- Mixed oscillators on hourly/daily charts warrant caution before placing any directional bets.

The AUD/USD pair once again showed some resilience below the 0.7600 mark and recovered around 35-40 pips from daily swing lows. The pair was last seen hovering near the top end of its intraday trading range, around the 0.7625-30 region, up 0.10% for the day.

The US dollar struggled to preserve its intraday gains, instead met with some fresh supply at higher levels amid the ongoing decline in the US Treasury bond yields. This, in turn, was seen as a key factor that extended some support to the AUD/USD pair. That said, a slight deterioration in the global risk sentiment might hold bulls from placing aggressive bets around the perceived riskier aussie and keep a lid on any further gains for the major.

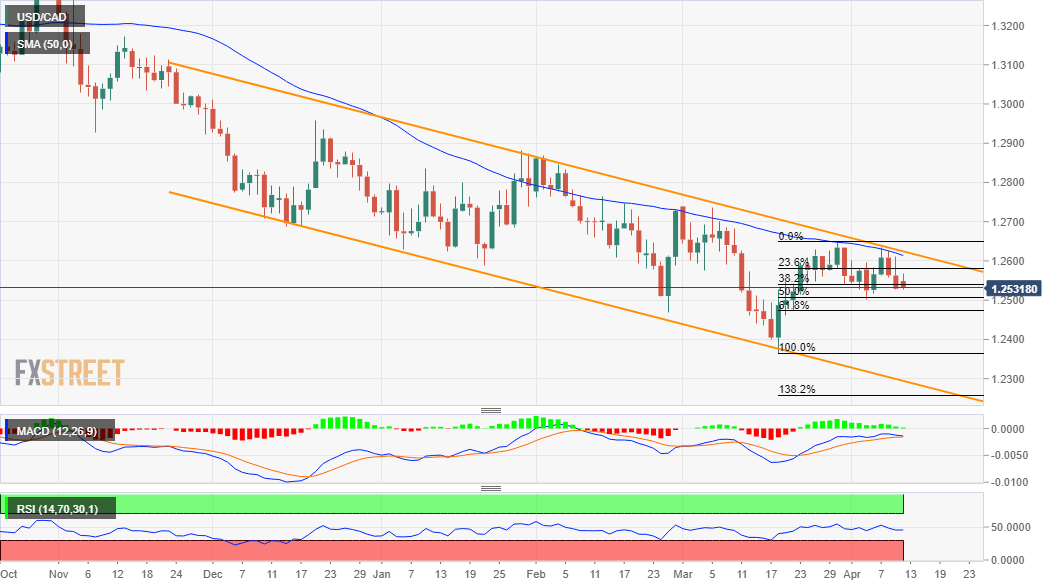

Looking at the technical picture, the pair has been oscillating in a 100 pips broader trading range since March 24. The range-bound price action constitutes the formation of a rectangle on short-term charts. Given the recent pullback from multi-year tops, around the 0.8000 psychological mark, this could be categorized as a bearish continuation pattern. The rectangle pattern, however, is not complete until a breakout has occurred in either direction.

Meanwhile, technical indicators on the daily chart maintained their bearish bias but have again started gaining positive traction on hourly charts. The mixed set-up further warrants some caution for aggressive traders and before positioning for any firm near-term direction. Hence, any subsequent move up might continue to face stiff resistance and runs the risk of fizzling out rather quickly near the 0.7660-70 region amid absent relevant fundamental catalyst.

That said, a sustained move beyond might negate any near-term bearish bias and prompt some short-covering move. The AUD/USD pair might then aim back to reclaim the 0.7700 round-figure mark. The short-covering move could further get extended and allow bulls to test the next relevant resistance near the 0.7745-50 supply zone.

Conversely, some follow-through weakness below the 0.7590-85 horizontal support should turn the AUD/USD pair vulnerable to retest YTD lows, around the 0.7530 region. The downward trajectory could further get extended and drag the pair below the key 0.7500 psychological mark, towards testing the next relevant support near the 0.7460 region.

AUD/USD 4-hour chart

Technical levels to watch