USD/CAD Price Analysis: Snaps two-day uptrend ahead of BOC

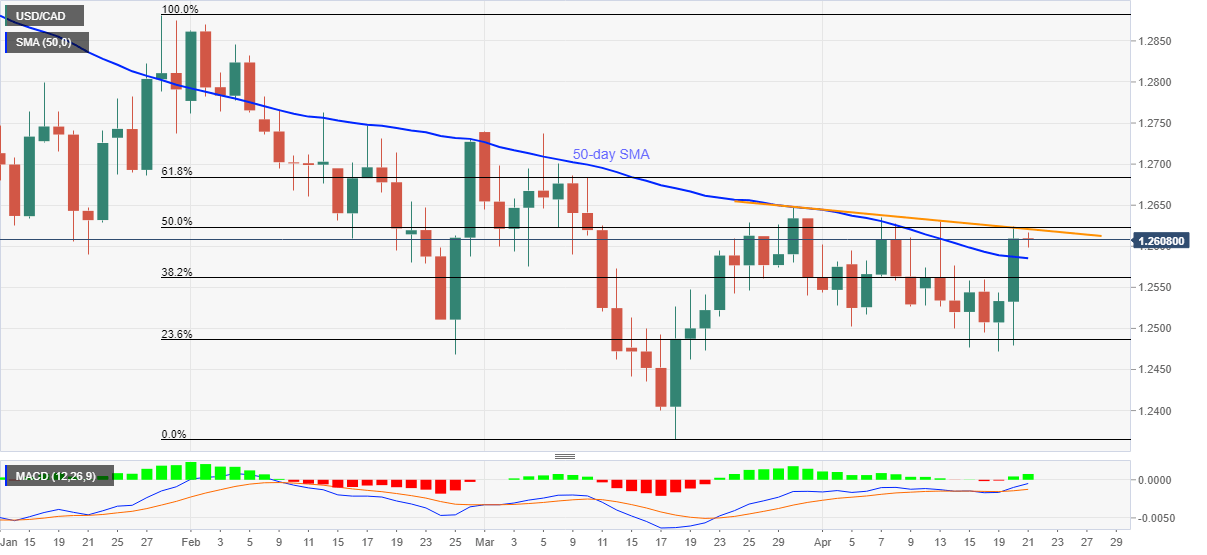

- USD/CAD takes offers around intraday low, extends pullback from monthly resistance line.

- Bullish MACD, sustained trading beyond 50-day SMA keeps buyers hopeful.

- BOC is expected to keep the benchmark rate unchanged, signal tapering.

USD/CAD holds lower grounds near 1.2600, despite the latest bounce off intraday bottom, during early Wednesday. In doing so, the quote justifies the previous day’s failures to cross the three-week-old falling trend line ahead of the Bank of Canad (BOC) monetary policy meeting.

Read: Bank of Canada Preview: Dovish surprise to lift USD/CAD

Although the loonie pair’s failure to cross the near-term key hurdle back sellers, bullish MACD and the successful break of 50-day SMA, around 1.2585 by the press time, portray the underlying momentum strength towards the north.

Hence, the BOC decision will be the key as any dovish surprise may quickly cross the stated resistance line and 50% Fibonacci retracement of January-March downside, near 1.2625.

The same could propel the quote towards the late March peak surrounding 1.2650 ahead of highlighting 61.8% Fibonacci retracement level of 1.2685.

However, a downside break below the 50-day SMA level of 1.2585, backed by an upbeat BOC outcome, may not hesitate to test the monthly low of 1.2471.

USD/CAD daily chart

Trend: Further weakness expected