Back

3 May 2021

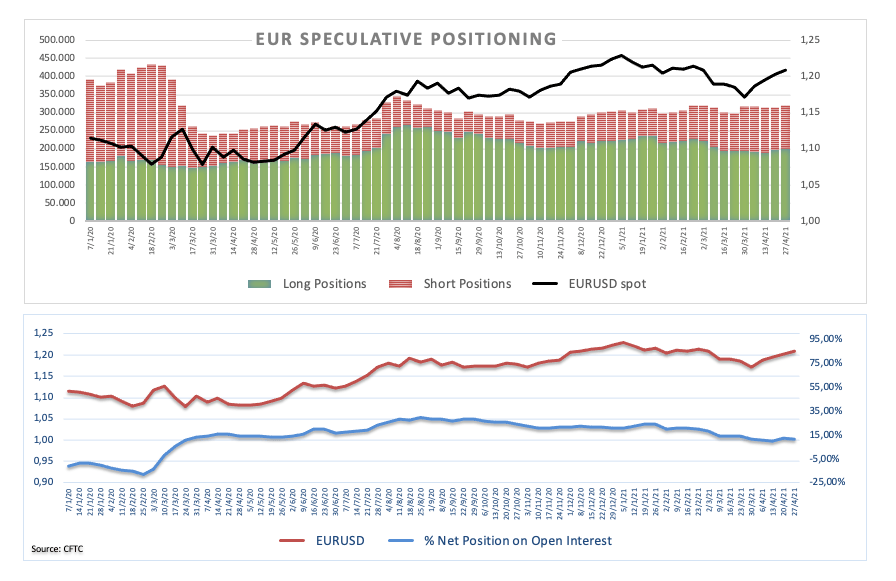

CFTC Positioning Report: EUR net longs rose to multi-week highs

These are the main highlights of the CFTC Positioning Report for the week ended on April 27th:

- Speculators added gross longs to their EUR positions for the second week in a row, taking net longs to the highest level since late March. The bid bias in the single currency was favoured by the investors’ shift to the progress of the economic rebound in Europe on the back of the faster pace of the vaccine rollout and positive results in the domestic docket.

- By contrast, speculative net longs in the dollar receded to YTD lows following declining US yields and the generalized upbeat note in the risk complex. The downtrend in the greenback was also sustained by the expected dovish message at the FOMC event (April 28) just after the cut-off date.

- Net shorts in JPY eased to levels last seen in mid-March in response to the loss of traction in US yields and the persistent sell-off in the US dollar.

- Net longs in the British pound climbed to nearly 2-month highs. Following the rejection from peaks in the 1.40 neighbourhood, Cable staged a corrective downside to the 1.38 area, where it met decent support amidst renewed political effervescence and positive UK growth prospects.