Back

21 Feb 2022

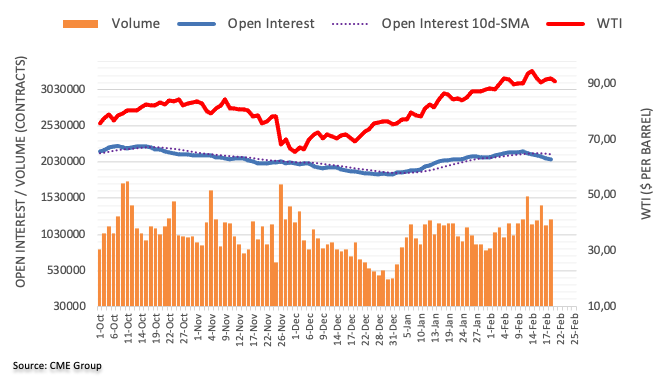

Crude Oil Futures: Room for further decline

CME Group’s flash data for crude oil futures markets noted open interest went down for the sixth session in a row on Friday, this time by nearly 16K contracts. On the other hand, volume increased by around 87.5K contracts, partially reversing the previous pullback.

WTI could slip back to sub-89.00 levels

Friday’s small downtick in prices of the WTI was on the back of shrinking open interest, allowing for the re-emergence of some weakness in the very near term. Against this, further correction could drag prices to, initially, the $88.80 region, where recent lows and a Fibo level (of the December-February rally) coincide.